ATLANTA – January is always one of the slowest months for vehicle sales, and there’s little reason to expect anything different this year. The selling pace slowed last quarter to 16.8 million, below 2019’s final sales of 17 million, and that same softness is likely to continue into the first part of 2020. Cox Automotive expects a 16.7 million monthly selling rate this January when sales are reported, the same as both December 2019 and January 2019. Sales volume of 1.11 million, based on 25 selling days, is expected to be down by 1.0% from last year.

“Cold and cloudy weather mixed with a post-holiday shopping hangover usually results in little consumer interest and weak sales activity, and that’s what is forecasted for this January.”

According to Cox Automotive Senior Economist Charlie Chesbrough: “Cold and cloudy weather mixed with a post-holiday shopping hangover usually results in little consumer interest and weak sales activity, and that’s what is forecasted for this January.”

However, January auto sales can be greatly influenced by two forces – harsh winter weather and excessive old inventory. Extreme weather can impact vehicle sales in winter months as shopping dealership lots becomes more difficult for many parts of the country. Thus far, this January has not seen massive snowstorms or cold across much of the country, unlike last year’s “Big Freeze” – a week of subzero temperatures which likely impacted last January’s vehicle sales. The other key ingredient is inventory levels, and how many old vehicle models remain after the holiday season sell-down incentive programs. OEMs generally want only new model years to remain in the market at the start of the year; otherwise, pricing is more challenging, and large incentives may be required. Data suggests inventory levels have improved in recent months, ending the year at their lowest levels since September 2015.

Record January auto sales occurred in 2000, at the peak of the dot-com bubble when the volume reached 1.21 million vehicles, and the SAAR was 18.1 million. Exceeding this record is not expected this January as there is little stimulus from either the economy or the market that would lift sales to this level. However, a higher than forecasted SAAR is possible given the strength of the underlying economy. Unemployment is at 50-year lows and the stock markets at near-record highs. Conditions for strong vehicle sales remain very favorable, but obstacles remain.

The overall vehicle sales pace is expected to trend lower in 2020, even though economic and consumer conditions remain strong. Affordability is a major concern in the vehicle market, as MSRPs and monthly payments continue to increase. Retail sales have been in decline in recent years, and this trend is likely to continue in 2020. In addition, previous vehicle sales present a major challenge to new vehicle sales, and that headwind will not subside any time soon. Five years of 17 million-plus new sales have created a large supply of “gently used” off-lease vehicles, and these are priced at a significant discount compared to new products. Many potential new-vehicle buyers looking for good value will be drawn into this used market. And, due to the time lag between new sales and used auctions, the types of products coming off-lease in 2020 will have more CUVs and Trucks, and more content, than in previous years.

Fleet activity has been an important story for 2018 and 2019 sales and will be a factor for 2020 as well. Fleet sales are up significantly over the last two years, and these gains have been supporting an otherwise declining retail market. How long the fleet surge will last is a critical unknown going into this year. With hundreds of thousands of additional fleet deliveries over the last two years, growth in 2020 from this high base will be challenging. Cox Automotive expects some pull-back in fleet activity, which supports our view of a modest decline in the total market this year.

January 2020 Sales Forecast Highlights

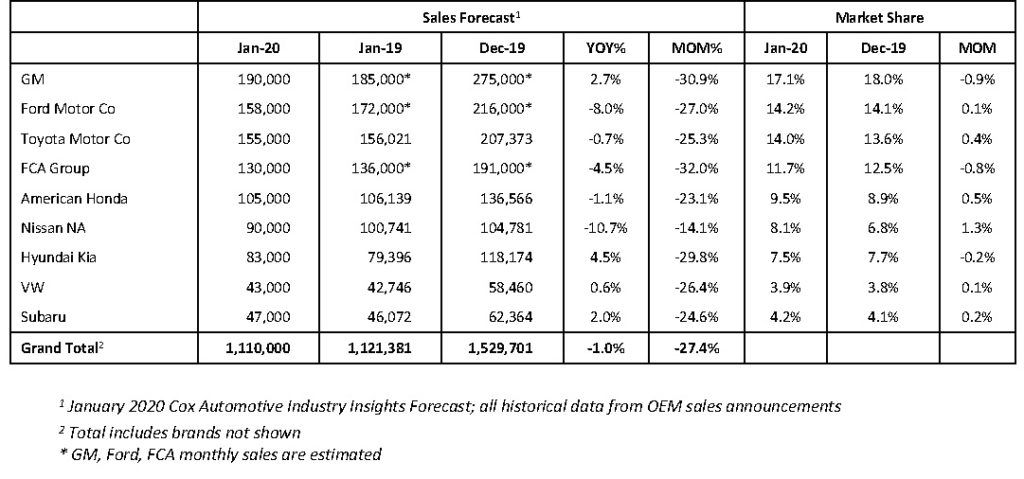

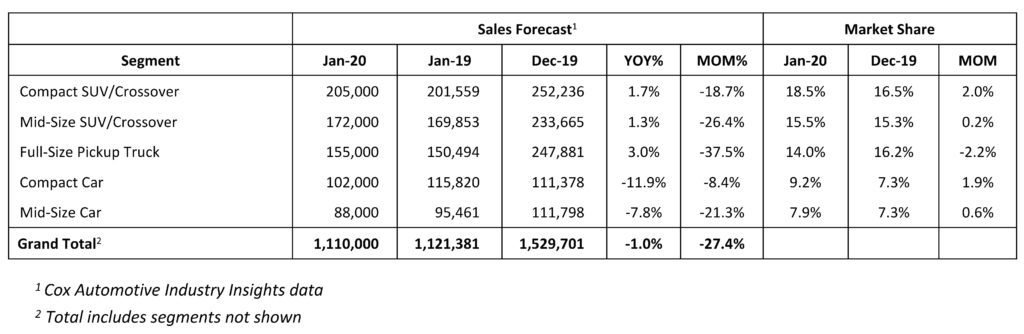

In January, new light-vehicle sales, including fleet, are forecast to fall to 1.11 million units, down about 10,000 units or 1.0% compared to January 2019. When compared to last month, sales are expected to decline over 400,000 units or 27%.

The SAAR in January 2020 is estimated to be 16.7 million, the same pace as where last month finished, and the same pace as last January. This January has 25 selling days, the same as last month and last year.

January 2020 Sales Forecast

*All percentages are based on raw volume, not daily selling rate.

Read: Deadline Extended for Women Driving Auto Retail Video Contest Submissions

Originally posted on Auto Dealer Today

0 Comments

See all comments